December 2025 Webinar

A Deep Dive into Rochdale’s Economic and Investment Outlook

December 11, 2025

December 11, 2025

2025 December Outlook Webinar Summary

Below is a summary, focusing on key insights from the December 11, 2025 Market Update webinar on the economy, financial markets and portfolio implications.

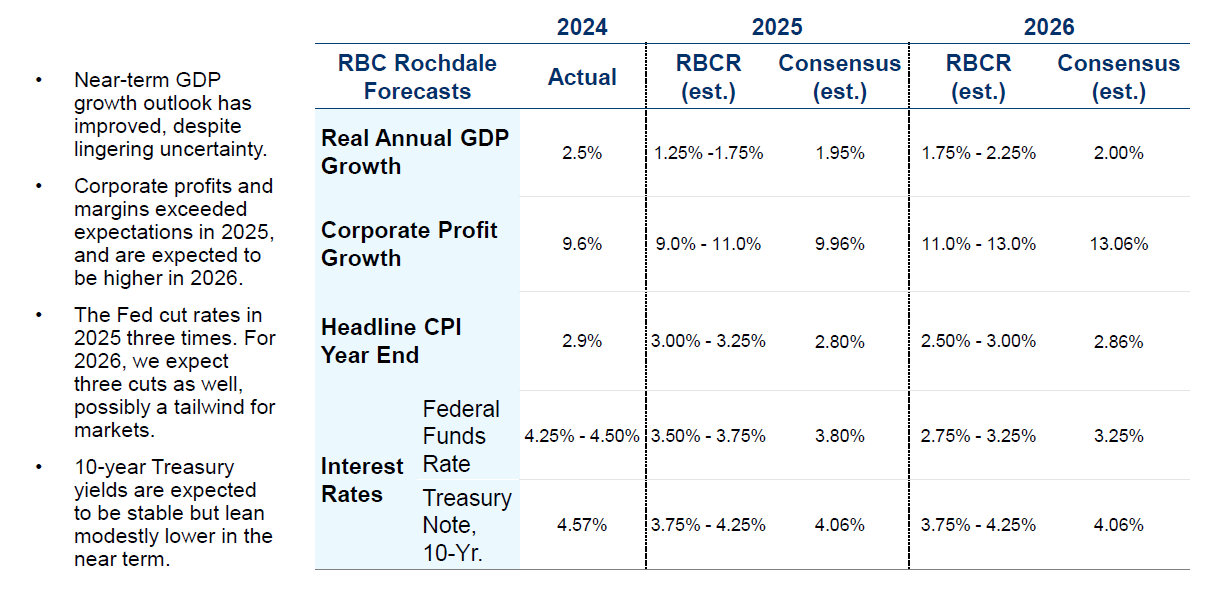

We expect real GDP growth to hold in a 1.75%–2.25% range into 2026 as productivity gains offset moderating labor growth and fiscal drag fades. Inflation is expected to trend toward 2.5%–3.0%, allowing the Federal Reserve to ease policy while keeping long-term interest rates rangebound.

Gross domestic product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period.

e: estimate. The consumer price index (CPI) measures the monthly change in prices paid by U.S. consumers.

Sources: Bloomberg, proprietary opinions based on Rochdale Research, as of December 4, 2025. Information is subject to change and is not a guarantee of future results.

Market Overview & Speedometers

Inflation

Labor

Consumer

Federal Reserve Policy

Equity Markets

Fixed Income Markets

International Markets

Five Key Takeaways

In Summary

We expect 2026 to unfold in a stable growth environment, with positive GDP growth in the U.S. as well as globally. Expect continued monetary policy easing and both fiscal stimulus and some fiscal restraint in the U.S., with fiscal stimulus primarily front loaded in the first half of the year. Globally, expect foreign fiscal stimulus to increase. Broadening market participation in the equity markets continue to be supported by the AI narrative along with consumer spending. Fixed income should remain a meaningful ballast, with a normalizing yield curve, positive real yields, and healthy credit conditions supporting returns.

Review Your Portfolio with Your Financial Advisor Today

RBC Rochdale encourages you to review your investment portfolio with your advisor. Contact our financial professionals today to get help with your wealth planning needs.

Index Definitions

The Standard & Poor’s 500 Index (S&P 500) is a market capitalization-weighted index of 500 common stocks chosen for market size, liquidity and industry group representation to represent U.S. equity performance.

Definitions

A consumer price index (CPI) measures changes in the price level of a market basket of consumer goods and services purchased by households. The CPI is a statistical estimate constructed using the prices of a sample of representative items whose prices are collected periodically.

Gross Domestic Product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period.

Important Information

The views expressed represent the opinions of RBC Rochdale, LLC, which are subject to change and are not intended as a forecast or guarantee of future results. Stated information is provided for informational purposes only, and should not be perceived as personalized investment, financial, legal or tax advice or a recommendation for any security. It is derived from proprietary and non-proprietary sources that have not been independently verified for accuracy or completeness. While Rochdale believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy or reliability. Statements of future expectations, estimates, projections and other forward-looking statements are based on available information and management's view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met, and investors may lose money. Diversification may not protect against market risk or loss. Past performance is no guarantee of future performance.

Indices are unmanaged, and one cannot invest directly in an index. Index returns do not reflect a deduction for fees or expenses.

Rochdale is free from any political affiliation and does not support any political party or group over another.

© 2025 RBC Rochdale, LLC. All rights reserved.

NON-DEPOSIT INVESTMENT PRODUCTS: • ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE