May 2025 Market Update Webinar

A Deep Dive into CNR’s Economic and Investment Outlook

May 29, 2025

May 29, 2025

2025 May Market Update Webinar Summary

City National Rochdale's (CNR) May 2025 Market Update Webinar: A Detailed Analysis

Since hitting an intra‑day low on April 7, the S&P 500 surged over 16%, marking one of the fastest equity rebounds in recent years. This quick reversal prompted questions about the sustainability of growth: Was the rally purely relief‑driven, or indicative of a deeper shift?

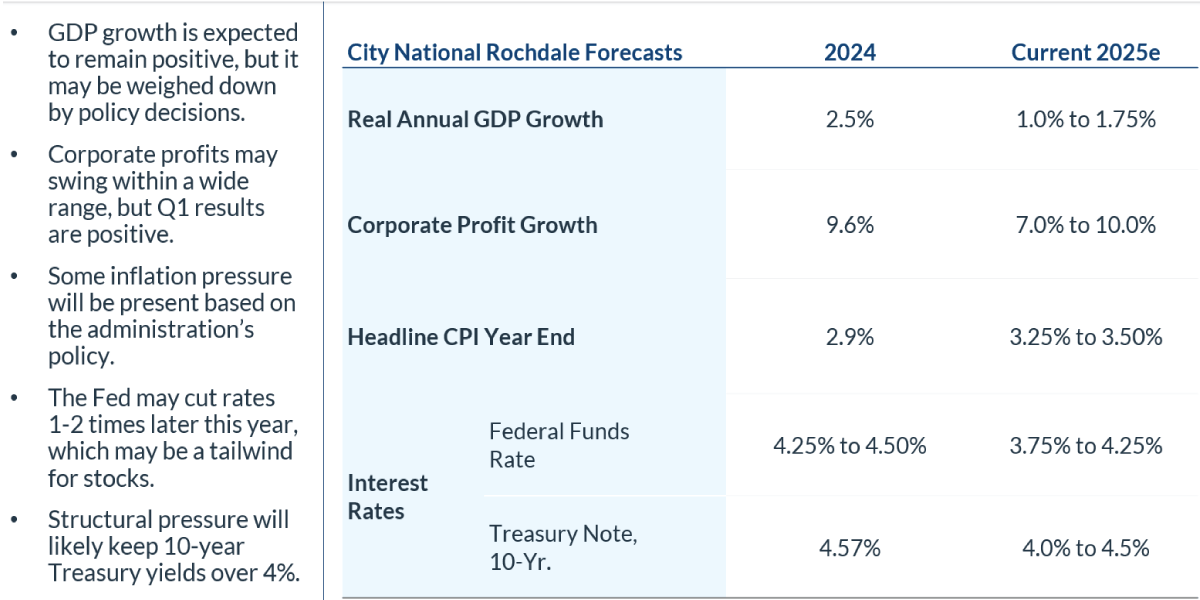

Gross domestic product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period.

e: estimate.

The consumer price index (CPI) measures the monthly change in prices paid by U.S. consumers.

Sources: Bloomberg, FactSet, proprietary opinions based on CNR Research, as of May 2025. Information is subject to change and is not a guarantee of future results.

Relief Rally Risks

Luke cautioned that this “relief rally” may overshoot. Markets appear more attuned to “good news” and dismissive of bad, introducing risks of overvaluation unless underlying fundamentals reaffirm the move.

Economic Landscape: Strong Core, Fragile Shell

Q1 GDP – Surface Weakness, Underlying Strength

Initial Q1 GDP showed a modest -0.3% decline, the first contraction since 2022. However, this was largely driven by a temporary spike in imports as firms front‑ran tariffs. Real final sales to private domestic purchasers rose by roughly 3%, indicating resilient consumer and business activity.

Interpretation: Core demand is intact; headline GDP weakness reflects short-term policy impacts, not recession dynamics.

Labor Market – Holding Firm

April’s non‑farm payrolls added ~252,000 jobs, with stable unemployment and rising participation — a robust labor market backdrop. However, federal hiring reductions (~200,000 jobs) are being monitored for possible regional knock‑on effects.

Tariff Shock and Trade Policy Realignment

Major Global Shift

April’s “Liberation Day” tariff policy marked a break with globalization: 25% tariffs on Canada/Mexico, 20% on China, and threats of additional tariffs elsewhere. Though many escalations were pulled back, China’s remains at ~145%, with a 10% reciprocal tariff floor.

Growth and Inflation Drag

CNR estimates a 0.1% GDP drag per 10% China tariff, plus another 0.2-0.3% from Canada/Mexico tariffs. Cumulatively, growth forecasts for 2025 have been lowered from 2-2.5% to 0.75-1.25%, with earnings trimmed and inflation forecasts raised.

Supply Chain and Sentiment Impact

Tariffs are not abstract; they elevate input costs, shake supply chains, and strain consumer sentiment. Surveys reveal rising inflation expectations and cautious consumer behavior. Fed Chair commentary signals legal and political risks around magnetic tariff tools.

Monetary Policy: The Stagflation Dilemma

Persistent Price Pressures

Though the latest CPI/PPI eased modestly, core inflation remains elevated. Given that imports make up ~10% of CPI, a 1% effective tariff hike adds about 0.1% to inflation — real, but manageable.

Fed’s Tightrope

With inflation near 2.9% and employment strong, the Fed faces a stagflation risk: If it fights inflation with hiking, growth may stall; if it eases to support growth, inflation may persist. Traders have priced in nearly 100 bps of cuts by year‑end, but Luke stresses the Fed is adopting a wait‑and‑see approach.

Market Volatility: Not a Crisis, But a Reset

Volatility of Policy Origin

Unlike crises rooted in leverage or institutional fragility, this storm originates from policy shifts. April’s record swings reflect the market digesting new norms — without systemic collapse.

Trading volumes spiked; credit spreads widened — but the system held. This signals an environment of recalibration rather than panic.

Strategic Volatility

Periods like this are part of systemic realignments, not breakdowns. They reset prices and introduce new volatility regimes, often creating valuation dislocations ripe for active investors.

Earnings and Sector Dynamics

Q1 Earnings Overview

Q1 marked seven consecutive quarters of earnings growth. For the S&P 500:

Leaders: Healthcare, Communication Services, IT. Lagging: Energy, due to low oil prices. Companies are pulling guidance due to trade uncertainty.

Sector Shifts

April also triggered a reevaluation of AI valuations, especially as Chinese AI entrants begin to challenge U.S. players. A broader theme of sector rotation emerged, favoring defensives (e.g., staples, utilities) while technology and industrials faced pressure.

Equity and Fixed Income Implications

Equity Outlook

Fixed Income Opportunity

Tactical and Strategic Considerations

Strategic Positioning

Tactical Flexibility

Monitor Key Triggers

Final Takeaways for Financially Savvy Investors

Summary

City National Rochdale’s May 2025 update boils down to a central thesis: We’ve entered a phase of purposeful realignment, driven by policy imperatives — chiefly tariffs and trade. Markets are digesting this through heightened volatility, but underneath, macro fundamentals (domestic demand, labor, earnings) remain resilient. Discipline, not daring, is the recommended posture:

Volatility isn’t noise to be tuned out; it’s information. And as Luke makes clear: Thoughtful navigation trumps prediction.

Review Your Portfolio with Your Financial Advisor Today

City National Rochdale encourages you to review your investment portfolio with your advisor. Contact our financial professionals today to get help with your wealth planning needs.

Index Definitions

The Standard & Poor’s 500 Index (S&P 500) is a market capitalization-weighted index of 500 common stocks chosen for market size, liquidity and industry group representation to represent U.S. equity performance.

Definitions

A consumer price index (CPI) measures changes in the price level of a market basket of consumer goods and services purchased by households. The CPI is a statistical estimate constructed using the prices of a sample of representative items whose prices are collected periodically.

Gross Domestic Product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period.

Important Information

The views expressed represent the opinions of City National Rochdale, LLC (CNR), which are subject to change and are not intended as a forecast or guarantee of future results. Stated information is provided for informational purposes only, and should not be perceived as personalized investment, financial, legal or tax advice or a recommendation for any security. It is derived from proprietary and non-proprietary sources that have not been independently verified for accuracy or completeness. While CNR believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy or reliability. Statements of future expectations, estimates, projections and other forward-looking statements are based on available information and management's view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met, and investors may lose money. Diversification may not protect against market risk or loss. Past performance is no guarantee of future performance.

Indices are unmanaged, and one cannot invest directly in an index. Index returns do not reflect a deduction for fees or expenses.

CNR is free from any political affiliation and does not support any political party or group over another.

© 2025 City National Rochdale, LLC. All rights reserved.

NON-DEPOSIT INVESTMENT PRODUCTS: • ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE