4Ps Analysis: A Proprietary Framework for Global Equity Allocation

City National Rochdale's approach is that, after asset allocation, the next important decision in portfolio construction is where to invest regionally. Our proprietary 4Ps analysis framework (Policies, Population, Potential, Profitability) seeks to identify the best opportunities for global equity investing over the coming decade.

We review the economic data for various countries and rank each based on the following criteria:

Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this document and are subject to change.

DEVELOPED MARKETS (DM)

After adding together the relative positioning, we arrive at a total equally weighted score (lower is better). The below describes our views and approach:

Policies are foundational for economic success

We separate Germany from Europe ex-UK for two reasons:

• We believe Germany is the strongest economy within the EU

• Germany provides a relative frame of reference for Japan, which is comparable in size

The population dynamics of a country are vitally important for productivity levels and successful economic growth A nation’s economic potential is ultimately a product of its labor force’s growth and productivity

More Workers + Higher Output per Worker = Stronger Economic Growth

Potential for innovation in industries of high intellectual property is important, as these industries tend to have higher secular growth and profitability, as well as the potential to provide higher wages to employees

A country’s venture capital community and technology-focused universities, combined with the creative spirit of innovation, are important factors

Profitability supports sustained competitive advantage

We believe the higher level of growth and profitability increases the amount of resources available to invest in the future, thus enhancing the economic outlook

*Europe xUK data includes Germany

Using our multifactor 4Ps framework, we strongly believe the U.S. is the best developed-markets country in which to find economic and profit growth, which ultimately drive stock returns

EMERGING MARKETS (EM)

Developed markets alone don’t offer much diversification benefits for U.S. investors. However, many investors mistakenly believe that all country indices are the same. We separate EM Asia from EM Non-Asia.

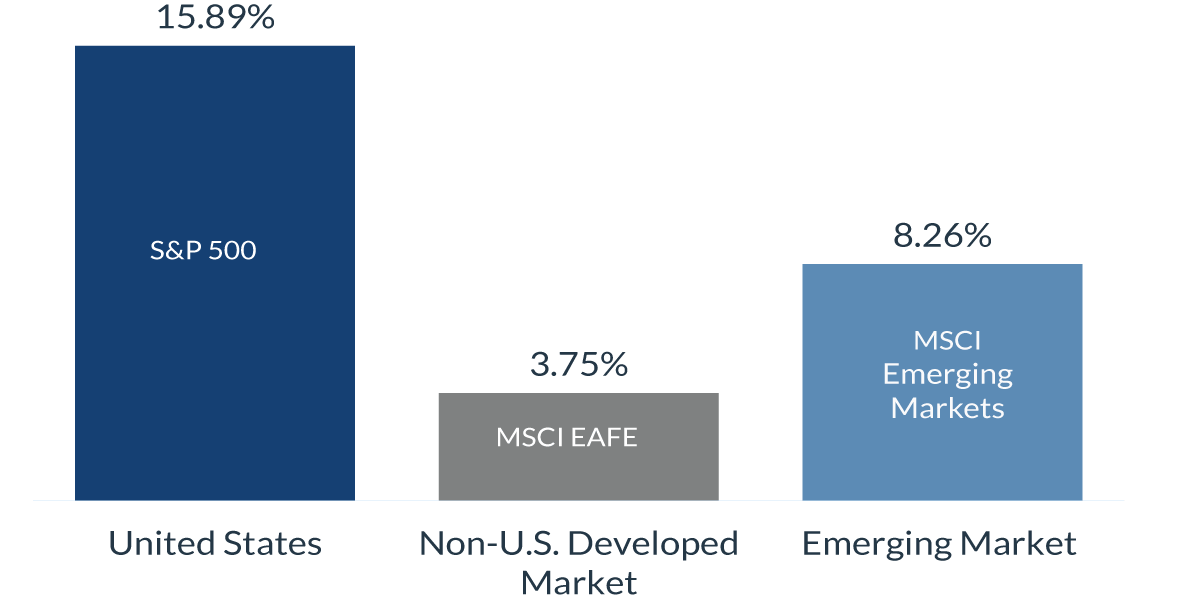

5 YEAR ANNUALIZED REGIONAL EQUITY MARKET PERFORMANCE

(AS OF JANUARY 31, 2024)

A relative comparison of historical equity index returns provides support for our conclusion that countries and/or regions that score better in our 4Ps framework should outperform over the long term.

For illustrative purposes only. Information is not representative of the performance achieved by any CNR product or service. The 4Ps process is one of a number of tools that CNR uses in determining global equity asset allocation. This represents a relative performance comparison of annualized 5 year regional equity index returns.

INDEX DEFINITIONS

S&P 500 Index (S&P500) is a stock market index that tracks the 500 most widely held stocks on the New York Stock Exchange or NASDAQ. It seeks to represent the entire stock market by reflecting the risk and return of all large-cap companies.

MSCI EAFE Small Cap Index (mscismal) is an equity index which captures small-cap representation across Developed Markets countries (Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the UK) around the world, excluding the U.S. and Canada. With 2,209 constituents, the index covers approximately 14% of the free float-adjusted market capitalization in each country.

MSCI Emerging Markets Asia Index (ndueegfa) is a free float-adjusted market capitalization index that is designed to measure equity market perfor-mance in the Asian emerging markets.

Indices are unmanaged, and one cannot invest directly in an index. Index returns do not reflect a deduction for fees or expenses.

Important Disclosures

The views expressed represent the opinions of City National Rochdale, LLC (CNR) which are subject to change and are not intended as a forecast or guarantee of future results. Stated information is provided for informational purposes only, and should not be perceived as personalized invest-ment, financial, legal or tax advice or a recommendation for any security. It is derived from proprietary and non-proprietary sources which have not been independently verified for accuracy or completeness. While CNR believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and management's view as of the time of these statements. Accordingly, such statements are inher-ently speculative as they are based on assumptions which may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements. Past performance or performance based upon assumptions is no guarantee of future results.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market.

There are inherent risks with equity investing. These risks include, but are not limited to stock market, manager, or investment style. Stock markets tend to move in cycles, with periods of rising prices and periods of falling prices.

Investing in international markets carries risks such as currency fluctuation, regulatory risks, and economic and political instability. Emerging mar-kets involve heightened risks related to the same factors as well as increased volatility, lower trading volume and less liquidity. Emerging markets can have greater custodial and operational risks, and less developed legal and accounting systems than developed markets.

Investments in emerging markets bonds may be substantially more volatile, and substantially less liquid, than the bonds of governments, govern-ment agencies, and government-owned corporations located in more developed foreign markets. Emerging markets bonds can have greater custodi-al and operational risks, and less developed legal and accounting systems than developed markets.

An asset allocation program cannot guarantee profits. Loss of principal is possible.

No representation is being made that employing the 4P framework will or is likely to achieve portfolio performance similar to that shown.

The 4P analysis is a proprietary framework for global equity allocation. Country rankings are derived from a subjective metrics system that combines the economic data for such countries with other factors including fiscal policies, demographics, innovative growth and corporate growth. These rankings are subjective and may be derived from data that contain inherent limitations.

Past performance is no guarantee of future performance.

© 2024 City National Rochdale. All rights reserved.

CITY NATIONAL ROCHDALE, LLC NON- DEPOSIT INVESTMENT PRODUCTS ARE: • NOT FDIC INSURED • NOT BANK GUARANTEED • MAY LOSE VALUE

Stay Informed.

Get our Insights delivered straight to your inbox.

Put our insights to work for you.

If you have a client with more than $1 million in investable assets and want to find out about the benefits of our intelligently personalized® portfolio management, speak with an investment consultant near you today.

If you’re a high-net-worth client who's interested in adding an experienced investment manager to your financial team, learn more about working with us here