Private Wealth Solutions Resource Library

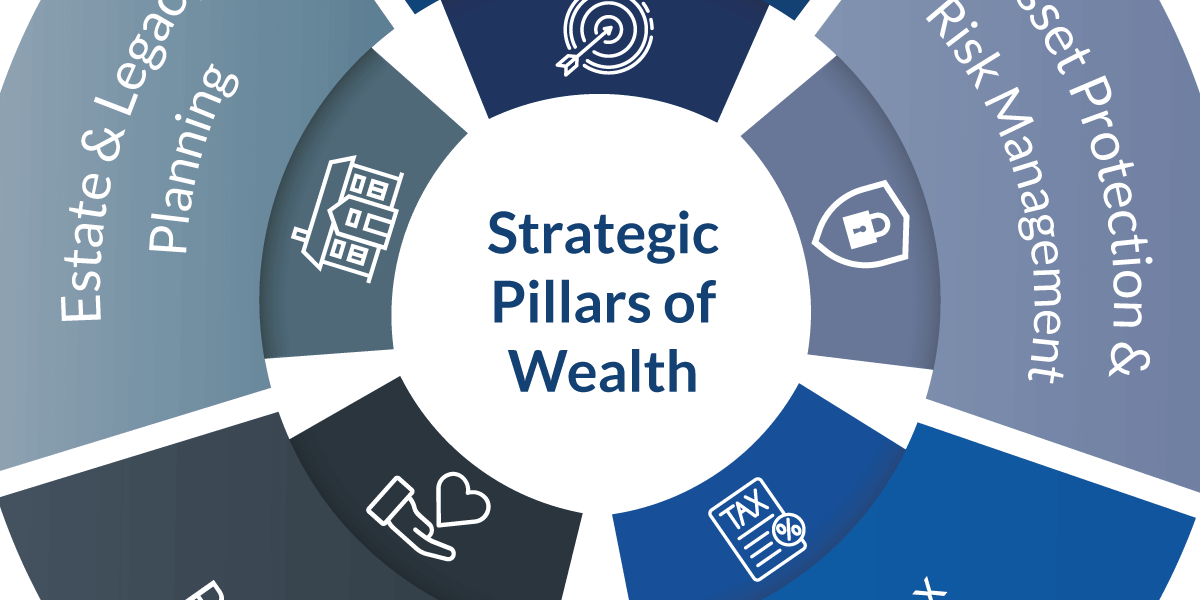

A complimentary, holistic service offered in collaboration with financial advisors to identify gaps and solutions and empower clients to make informed decisions that will serve to optimize their wealth.

A complimentary, holistic service offered in collaboration with financial advisors to identify gaps and solutions and empower clients to make informed decisions that will serve to optimize their wealth.

.jpeg)

Important Information

This page is for general information and education only. It is not meant to provide specific tax guidance. The information in this document was compiled by the staff of City National Bank (City National) from data and sources believed to be reliable, but City National makes no representation as to the accuracy or completeness of the information. The opinions expressed, together with any estimates or projections given, constitute the judgment of the author as of the date of the presentation. City National has no obligation to update, modify, or amend this document or otherwise notify you in the event any information stated, opinion expressed, matter discussed, estimate, or projection changes or is determined to be inaccurate.

City National Bank, its managed affiliates and subsidiaries, as a matter of policy, do not give tax, accounting, regulatory, or legal advice. Rules in the areas of law, tax, and accounting are subject to change and open to varying interpretations. Any strategies discussed in this document were not intended to be used, and cannot be used for the purpose of avoiding any tax penalties that may be imposed. You should consult with your other advisors on the tax, accounting and legal implications of actions you may take based on any strategies or information presented taking into account your own particular circumstances.

This presentation (or any portion thereof) may not be reproduced, distributed, or further published by any person without the written consent of City National. Professional trustee services are offered to City National Rochdale clients by City National Bank which may serve as trustee.

City National Rochdale, LLC is an SEC-registered investment adviser and wholly-owned subsidiary of City National Bank. Registration as an investment adviser does not imply any level of skill or expertise. City National Bank is a subsidiary of the Royal Bank of Canada.

© 2025 City National Rochdale. All rights reserved.

| CITY NATIONAL ROCHDALE, LLC NON-DEPOSIT INVESTMENT PRODUCTS ARE: • NOT FDIC INSURED • NOT BANK GUARANTEED • MAY LOSE VALUE |